All Categories

Featured

Table of Contents

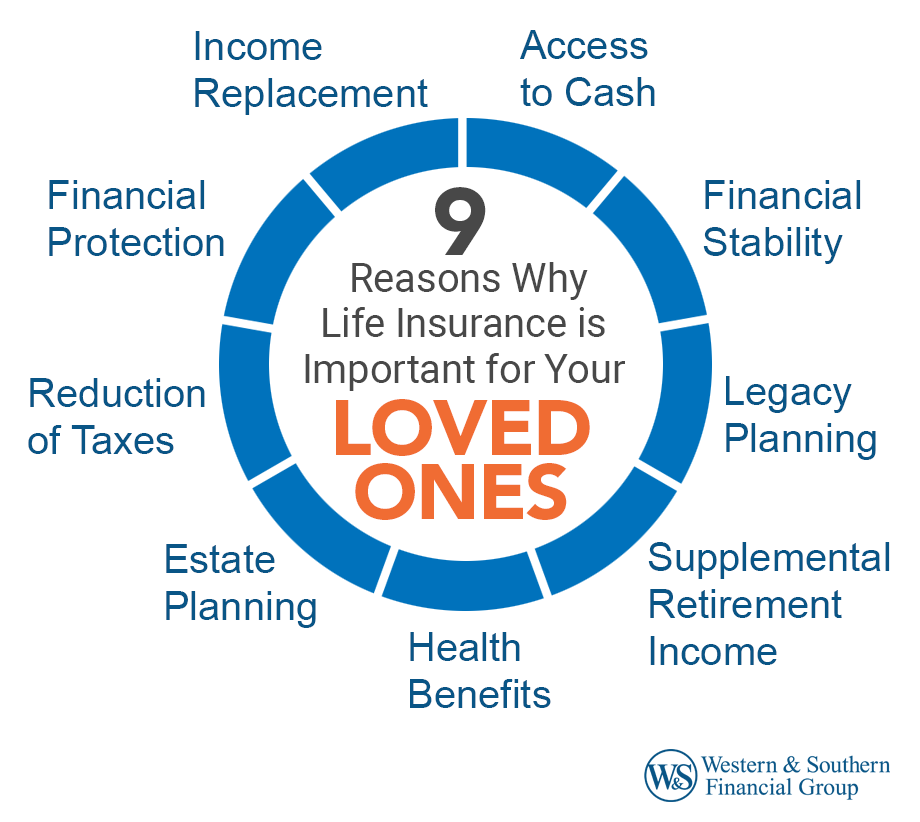

You can obtain versus the cash money value of your policy for things like tuition repayments, emergencies and also to supplement your retired life earnings (Life insurance). Remember, this still is considered a funding, and if it's not paid back before you die, then your survivor benefit is minimized by the quantity of the funding plus any type of superior passion

Generally, a biker is utilized to personalize your plan to fit your requirements. If you're terminally ill, an increased death advantage motorcyclist may pay out a portion of your fatality advantage while you're still to life. You can make use of the payment for points like clinical expenditures, to name a few uses, and when you pass away, your recipients will certainly receive a reduced life insurance advantage since you utilized a part of the policy already.

Speak with your American Household Insurance coverage agent to see if your American Family Members Life Insurance provider policy has living benefits. In the meantime, take a look at our life insurance policy protections to see which choice is best for you and your loved ones. This information stands for only a short summary of protections, is not part of your policy, and is not a promise or guarantee of coverage.

Insurance coverage policy terms and conditions might apply. Exclusions might use to plans, endorsements, or cyclists. Policy Types: ICC17-225 WL, Policy Kind L-225 (ND) WL, Plan Type L-225 WL, Plan FormICC17-225 WL, Policy Form L-226 (ND) WL, Plan Form L-226 WL, Plan Kind ICC17-227 WL, Policy Form L-227 (ND) WL, Plan Form L-227 WL, ICC21 L141 MS 01 22, L141 ND 02 22, L141 SD 02 22.

What is Family Protection?

Commonly, there are several types of life insurance policy choices to think about: term life insurance policy, whole life insurance coverage, and universal life insurance policy. Death advantages are typically paid in a round figure repayment. This money can cover costs like medical expenses, end-of-life expenses, arrearages, mortgage repayments, medical insurance, and tuition. A minimum of 3 in four American grownups indicated they own some sort of life insurance policy; nevertheless, ladies (22%) are twice as likely as guys (11%) to not have any kind of life insurance policy.

This can leave much less money to spend for expenses. At a time when your enjoyed ones are already handling your loss, life insurance policy can help reduce a few of the monetary concerns they may experience from lost revenue after your passing away and assistance give a monetary safety internet. Whether you have a 9-to-5 task, are independent, or have a local business, your current revenue could cover a part or all of your family members's daily requirements.

44% responded that it would certainly take less than six months to experience economic challenge if the key breadwinner passed away. 2 If you were to pass away suddenly, your other member of the family would still require to cover these continuous house expenditures even without your earnings. The life insurance policy death advantage can assist replace revenue and make sure economic security for your loved ones after you are no longer there to attend to them.

Is Riders worth it?

Your family members could make use of some of the death benefit from your life insurance coverage policy to aid pay for these funeral service expenditures. The plan's beneficiary might guide some of the fatality benefits to the funeral home for final expenses, or they can pay out-of-pocket and make use of the fatality advantage as compensation for these expenses.

The "Human Life Value" (HLV) concept pertains to life insurance and financial preparation. It stands for a person's value in terms of their financial contribution to their household or dependents.

What does Retirement Planning cover?

Eighth, life insurance coverage can be utilized as an estate planning device, assisting to cover any type of essential estate tax obligations and final expenditures - Final expense. Ninth, life insurance coverage policies can offer certain tax obligation advantages, like a tax-free survivor benefit and tax-deferred cash worth buildup. Life insurance policy can be an essential part of protecting the monetary safety and security of your loved ones

Talk with among our economic specialists about life insurance coverage today. They can assist you evaluate your requirements and find the right policy for you. Rate of interest is charged on fundings, they might create a revenue tax responsibility, decrease the Account Value and the Survivor Benefit, and may create the plan to lapse.

Why is Life Insurance Plans important?

The Federal Government developed the Federal Personnel' Team Life Insurance (FEGLI) Program on August 29, 1954. It is the largest team life insurance policy program in the globe, covering over 4 million Federal staff members and retirees, along with most of their household participants. Most workers are qualified for FEGLI protection.

Therefore, it does not accumulate any kind of cash money worth or paid-up value. It contains Fundamental life insurance policy protection and three options. For the most part, if you are a brand-new Federal worker, you are immediately covered by Standard life insurance policy and your payroll workplace subtracts costs from your paycheck unless you forgo the protection.

You should have Standard insurance coverage in order to choose any of the alternatives. Unlike Basic, registration in Optional insurance is not automated-- you need to take activity to elect the options.

What is Wealth Transfer Plans?

You pay the full price of Optional insurance coverage, and the expense relies on your age. The Office of Federal Worker' Group Life Insurance Policy (OFEGLI), which is an exclusive entity that has an agreement with the Federal Federal government, processes and pays insurance claims under the FEGLI Program. The FEGLI Calculator permits you to figure out the face value of various mixes of FEGLI coverage; calculate costs for the different mixes of coverage; see how selecting various Alternatives can alter the amount of life insurance policy and the premium withholdings; and see how the life insurance policy carried into retired life will change with time.

Possibilities are you may not have sufficient life insurance policy protection for yourself or your liked ones. Life occasions, such as marrying, having children and buying a home, may trigger you to require more defense. Term life insurance protection is available to eligible employees. MetLife finances the life insurance protection.

You will pay the same month-to-month premium regardless of the variety of youngsters covered. A youngster can be covered by just one parent under this Strategy. You can enlist in Optional Life insurance policy and Dependent Life-Spouse insurance during: Your preliminary enrollment; Open up enrollment in October; orA unique qualification situation. You can enroll in Dependent Life-Child insurance during: Your preliminary registration; orAnytime throughout the year.

You may desire to take into consideration life insurance coverage if others depend on your earnings. A life insurance plan, whether it's a term life or whole life policy, is your individual property.

What does Life Insurance cover?

Here are several cons of life insurance: One downside of life insurance policy is that the older you are, the more you'll pay for a policy. This is since you're most likely to pass away throughout the plan duration than a younger policyholder and will, consequently, set you back the life insurance policy business even more cash.

Latest Posts

Aaa Burial Insurance

Best Final Expense Insurance Company To Work For

Final Expense Network Reviews